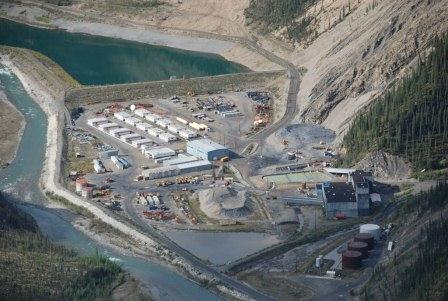

Harmony Gold Mining Company Limited (HMY) shook hands with Australian gold miner Newcrest Mining to buy half of its share in the Hidden Valley mine in Papua New Guinea. The two miners announced on Monday that Harmony will buy 50% interest in the Hidden Valley joint venture for a cash consideration of $1.00.

“Having completed the strategic review of Hidden Valley, Newcrest determined that the best outcome was to exit the operation and focus our attention on safe, profitable growth at our other assets,” said Newcrest MD and CEO, Sandeep Biswas, in a statement.

Peter Steenkamp, Harmony CEO, said that buying the stake in the Hidden Valley mine fits within the overall aspiration of the South Africa-based group, which is to grow its annual production profile to 1.5-million ounces within three years. (See also: Most Profitable Gold Mining Companies of 2016.)

“We believe that Hidden Valley has the potential to contribute approximately 180 000 ounces per year of gold to Harmony’s production profile at an all-in sustaining cost of less than $950 per ounce within the next three years,” Steenkamp said.

As part of the transaction, all liabilities and expenses related to the mine now belong to Harmony. These include all closure, rehabilitation and remediation obligations, effective from August. According to Mining Weekly, Newcrest said that it would reverse the $35-million provision for rehabilitation obligations for Hidden Valley, which it made at the end of the financial year in June.

The two partners are not done dealing, however. In addition to its 50% stake in Hidden Valley, Newcrest has also signed an agreement to sell its 50% interest in certain regional exploration tenements adjacent to Hidden Valley, to Harmony, Mining Weekly reports.

Harmony, which has seen its shares soar 263% year-to-date, expects Hidden Valley to generate strong free cash flows in the initial investment phase. (See also: Harmony Gold Mining Traded Ex-Dividend.)

Investopedia